Avalara Oxid Module¶

User Manual¶

from Version 2.0.x

Overview¶

- Name: Avalara

- Category: Shopping Process

- Module Language(s): English, German

- Author: derken mediaopt GmbH

- Link: http://projects.mediaopt.de/projects/mopt-hme/wiki

- Contact: support@mediaopt.de

- Version 2.0.0 (2017) landed cost beta

The Avalara OXID module simplifies the handling of exporting products to countries like Canada and the USA. The USA is known for an unclear tax system. So Avalara takes over the accounting of taxes. The module connects your Oxid Shop to Avalara. For each transaction to selected countries, the customers of your shop will get a runtime tax result for their current order. After an order has been placed the data and the tax result will be transmitted to Avalara and Avalara will report the taxes to the corresponding agency.

The module offers many settings to adapt your products to each tax-system.

Getting Started¶

This manual shows you step by step how to install the module to your online shop. Please test the installation and the configuration of the module on a test system before installing it on your live shop.

Requirements¶

- OXID eShop versions: 4.9.x CE; 5.2.x PE/EE

- PHP-Version: 5.4 or higher

Installation¶

If you have concerns about the installation process, then use the help of experts to save and modify your system.

Follow the instructions for a seamless installation.

The installation itself includes three steps:

- Establish a connection to your web server e.g. via FTP

- Copy the content of the copy_this-directory to your shop root-directory

- Delete your temp-directory of your shop

Before activating the model, append the following code to /modules/functions.php

include_once(__DIR__ . '/mo/mo_avalara/bootstrap.php');

Then activate the module in your backend via Extensions->Module

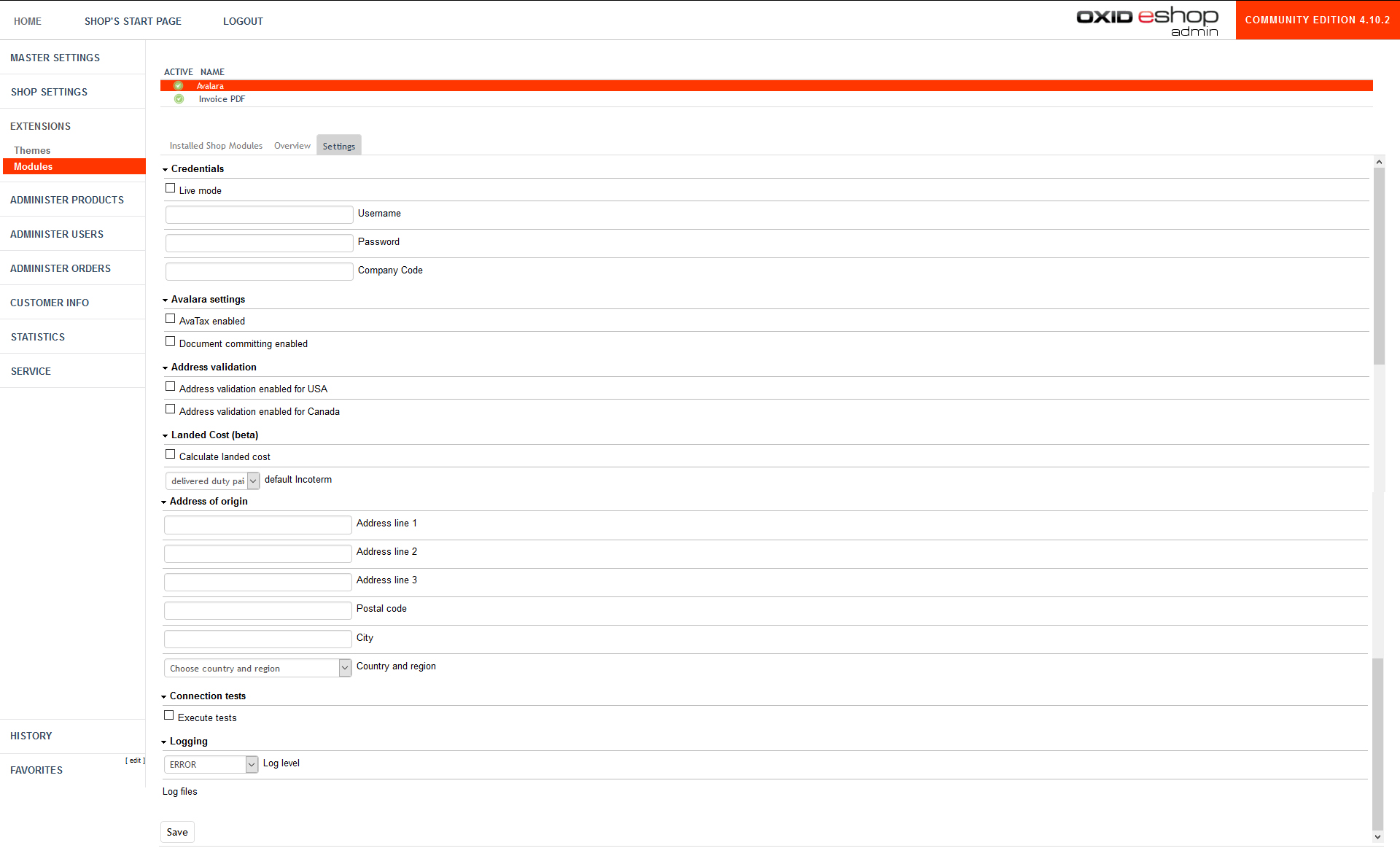

Configuration¶

Credentials:

- Live mode: Choose between working on a live or on a sandboxed environment.

- Username: Fill in the name of your Avalara account.

- Password: Fill in the password for your Avalara account.

- Company code: Fill in your company code you use in the Avalara admin console.

Avalara settings:

- AvaTax enabled: Activate the checkbox to enable the Avalara SalesTax Calculation for frontend actions.

- Document committing enabled : Disable document committing will result that all calls will be done with DocType=SalesOrder and suppress any non-getTax calls (i.e., CancelTax, UpdateTax).

- Log level: Choose the log level to determine which messages will be logged. Choose "Error" in productive mode.

Address validation:

Choose the delivery countries, which should be covered by the Avalara Tax Calculation.

Landed Cost (beta):

DDP The Seller (or their 3 rd party) bears the risk & responsible of coordinating the export clearance, transportation and declaring shipment to the customs authority in the destination country and eremitting any/all customs duty & import tax (including VAT).

DAP is currently not available.

Address of origin:

Fill in the business address data of your concern.

Actions:

The connection test is successful if you have entered and saved your (valid) credentials.

Functionality¶

Avalara has to identify the tax rates for specific products. To this end, use Avalara tax codes, which precisely identify the correct tax for a class of products. To find the correct tax code, Avalara provides a tax code finder: http://taxcode.avatax.avalara.com/.

Notice: If a product is not linked to any tax code, Avalara assumes a default tax code.

Article Tax Code¶

You can link your article directly to a tax code by entering the tax code in Administer Products > Products > Choose product > Avalara Tab. A tax code on a specific article is preferred over a tax code linked to the article's category.

Category Tax Code¶

You can link all items in a category to a tax code by entering the tax code in Administer Products > Categories > Choose category > Avalara tab.

Shipping Taxcode¶

Dispatching goods in several ways can also change the tax rates. So you can insert a tax code for shipping via Shop Settings > Shipping Methods > Choose Shipping > Avalara tab.

Voucher Tax Code¶

Voucher or discounts which are valid for all articles do not need a tax code. In the case of a manufacturer's coupon or article-based coupon, you have to specify a tax code to the voucher. Restrict the voucher to an item or supplier with activation of the restrict discount button and enter the tax code. You will find the settings of a voucher in Shop Settings > Coupon Series > Choose Coupon > Avalara tab.

Customer Exemption Code¶

Some customers (e.g., associations) can purchase without paying taxes. In this case, you can enter an exemption code for the affected customer in Administer Users > Users > Choose user > Avalara tab. Then, the Avalara module ignores the taxes on each order of a customer with exemption code.

After Sale Features¶

The Avalara module offers to cancel an order, which was already transmitted to Avalara.

Order Cancelation¶

If an order is canceled for some reason, you have to transmit this information to Avalara by clicking the "Cancel Tax" button on Administer Orders > Orders > Choose order > Avalara tab. Then, the order is voided in Avalara. (This does not influence the order in your shop.)